Washington, DC — The Federal Railroad Administration this week announced 70 projects across 35 states selected to receive funding through the Consolidated Rail Infrastructure and Safety Improvements (CRISI) Program, a competitive discretionary grant focused on freight and passenger rail infrastructure.

CRISI is for projects that improve the safety, efficiency, and reliability of freight and intercity passenger rail service. It’s the only federal funding for which short line railroads are directly eligible and it is critical for helping them tackle projects like track rehabilitation, the repair or replacement of aging bridges, improving grade crossings, or eliminating bottlenecks.

The Bipartisan Infrastructure Law allocated an additional $1 billion annually for the program, up from $360 million in FY 2021. It also expanded eligibility to include projects that foster rail innovation, reduce emissions, or improve pedestrian safety along railroad tracks.

“For years, the CRISI Program has helped to maintain and modernize America’s freight rail network, and it’s the only federal grant program prioritizing smaller, short line railroads vital to our nation’s economy and regional supply chains. With unprecedented levels of funding through President Biden’s Bipartisan Infrastructure Law, FRA is advancing even more projects and laying the groundwork for further transformation,” said FRA Administrator Amit Bose in a press release.

Takeaways:

- These are the first CRISI grants awarded at the new $1.4 billion funding level

- FY22 funding will support 70 projects in 35 states and Washington, D.C.

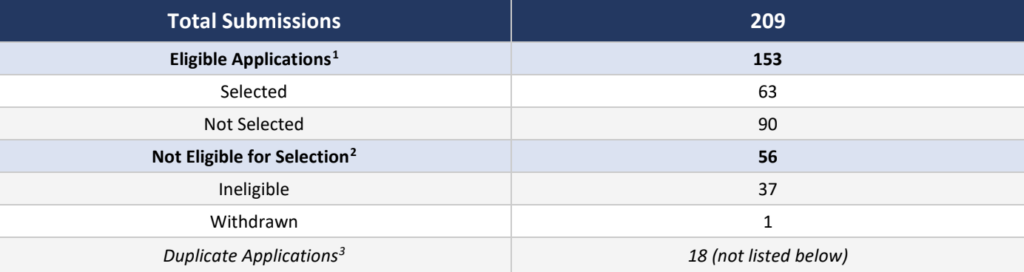

- The FRA received 234 eligible applications with requests totaling $6.1 billion for the grants

- Over $600 million is allocated to freight-railroad projects

- Around $100 million will go toward funding environmentally friendly locomotive projects

Project highlights:

- $178.4 million to restore passenger service in parts of Alabama, Louisiana and Mississippi along the Gulf of Mexico for the first time since Hurricane Katrina struck in 2005

- $72.8 million to the Palouse River & Coulee City Railroad in Washington state to upgrade track and related infrastructure, which will enable the rail line to handle modern 286,000-pound railcars

- $29.5 million to make improvements to 280 miles of track and other infrastructure along the Paducah and Louisville Railway in Kentucky

- $23.7 million for upgrading about 42 bridges on 10 different short-line railroads in Tennessee

- $59 million in New Jersey to help replace Conrail’s Point-No-Point Bridge, a 124-year-old swing bridge that handles 7,000 freight cars a day

Visit our Rail Grant Hub for news and specific details regarding the funding programs available for rail infrastructure.