Washington, DC — Gross domestic product. Consumer spending. Unemployment. Interest rates. These are the categories that come to mind when we assess the health of the economy. Each tells its own story—helping economists, reporters, policymakers, and the public predict where we’re headed and identify trends and opportunities.

Add a new indicator to this list: the Freight Rail Index (FRI), a recently introduced measure of the most economically sensitive rail traffic. The Association of American Railroads (AAR) on July 8 announced the FRI along with a new, free monthly publication – the Rail Industry Overview (RIO) – to offer timely and digestible insights into what rail traffic is saying about the U.S. economy.

“Whether it is housing, energy markets or consumer spending, rail traffic touches them all,” said AAR Chief Economist Rand Ghayad. “At a time when various indicators suggest very different paths ahead for the economy, rail traffic data is a common thread that can help connect the dots.”

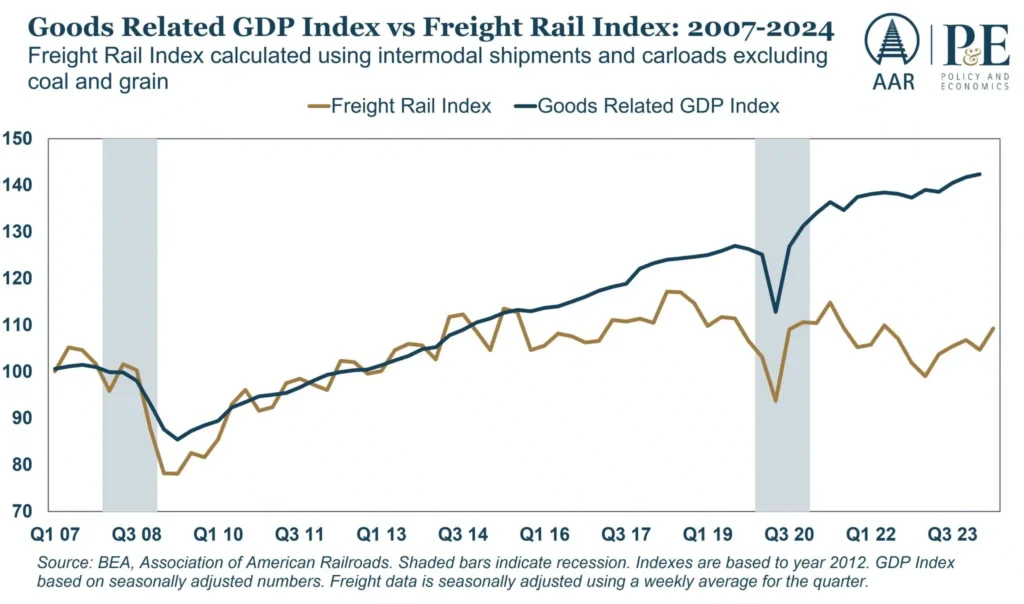

The FRI accounts for intermodal and carload traffic but excludes coal and grain, as their volumes are influenced by variables such as weather and shifts in energy markets, which are less directly tied to broader economic conditions. Historically rail freight activity and GPD move closely together, according to Ghayad.

The release of the FRI and RIO is an effort by the AAR to “[pull] back the curtain to help the public understand what the industry is seeing coming down the tracks,” they said in a statement. The association already publishes weekly rail traffic data on carloads and intermodal traffic across North America, noting that leading economists like those at the Federal Reserve utilize this information.

Despite the current feeling of economic uncertainty, the most recent rail data available from June suggests optimism for the road ahead.

“Over the recent period, FRI has been gradually growing thanks in part to strong consumer spending that has fueled growth in intermodal traffic activity across the country. This is everything moved in trailers and containers from plastic pellets to the cell phones you’re holding in your hand,” said Ghayad in a video update.

“We’ll continue to watch whether consumers are going to pull back or if the Fed decides to cut interest rates earlier than expected. But from the railroads’ point of view, the economy is still chugging along.”

To subscribe to the new monthly Rail Industry Overview (RIO) and read more about the FRI, visit: https://www.aar.org/rail-industry-overview/.