Washington, D.C. — A March 29 report from the Association of American Railroads (AAR) offers a compelling look at the relationship between North American railroads and international trade. While we already knew that freight railroads haul about one-third of U.S. exports, the new data goes further in demonstrating the depth of rail’s ties to trade.

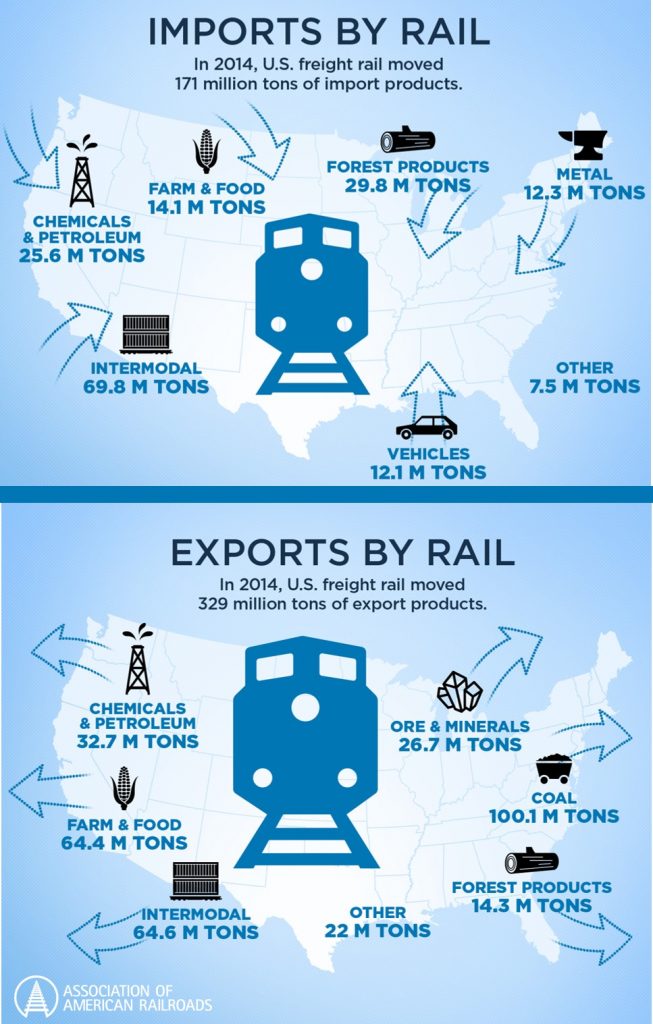

When American companies conduct trade, they directly support “a huge swath of freight rail operations.” By the numbers:

- 42% of rail carloads and intermodal units are directly associated with international trade;

- 35% of annual rail revenue is directly associated with international trade;

- 50,000 rail jobs, worth over $5.5 billion in annual wages and benefits, depend directly on trade.

Trade-associated rail traffic can be found in every part of the country. In Maryland, Virginia, the Gulf Coast and the great lakes, trains move coal to ports for export. Midwest paper and forest product imports are moved by rail from Canada. Containers of consumer goods originating in Asia arrive at ports in Los Angeles, Long Beach, Oakland, Tacoma, Savannah, Norfolk, and Newark and reach the rest of the country via rail. Trains take Midwest grain to the Pacific Northwest and Gulf Coast for export. The examples go on – from outbound Minnesota iron ore to the import and export of automotive products for factories in dozens of U.S. states.

Trade-associated rail traffic can be found in every part of the country. In Maryland, Virginia, the Gulf Coast and the great lakes, trains move coal to ports for export. Midwest paper and forest product imports are moved by rail from Canada. Containers of consumer goods originating in Asia arrive at ports in Los Angeles, Long Beach, Oakland, Tacoma, Savannah, Norfolk, and Newark and reach the rest of the country via rail. Trains take Midwest grain to the Pacific Northwest and Gulf Coast for export. The examples go on – from outbound Minnesota iron ore to the import and export of automotive products for factories in dozens of U.S. states.

For their part, railroads are investing what it takes—some $630 billion since 1980—to keep American businesses competitive in the global economy. These private dollars maintain and grow the rail network that companies depend on for connecting to international markets.

Rail’s commitment to infrastructure is even more visible given the poor condition of other U.S. infrastructure areas, like roads and bridges. In its recently released 2017 Infrastructure Report Card, the American Society of Civil Engineers awarded the top mark in the report, a “B” grade, to freight railroads while giving the nation’s overall infrastructure a “D+.”

“For a highly capital-intensive industry that has spent $26 billion annually in recent years, private investment is the lifeblood of a freight rail sector that must devote massive sums to safely, efficiently and affordably deliver goods across the economy,” said Edward Hamberger, president and CEO of AAR. “Upending the ability of railroads to do so by undermining free trade agreements that have done far more good than harm would have far reaching effects.”

For policymakers—including President Trump, who has promised to pursue an aggressive trade agenda—the lesson is clear: “proceed with caution” on trade because it is an essential driver of the U.S. economy.

While globalization has negatively impacted certain domestic industries and workers, its negative footprint is overstated. Of the 5.6 million U.S. manufacturing jobs lost between 2000-10, for example, only 13 percent were lost due to trade, while 85 percent were lost due to productivity growth from automation and new technologies, according to a 2015 study by the Center for Business and Economic Research at Ball State University.

In contrast, international trade today supports some 40 million jobs across the U.S.—including the 50,000 rail jobs highlighted in the report—and benefits countless more consumers. Trade policy moving forward should recognize these realities of the globalized world. Stepping away from trade would not only undermine U.S. railroads but the economy as a whole.