Washington, D.C. — Last fall, the U.S. Surface Transportation Board (STB) announced several new proposals that would negatively impact freight railroads and their ability to invest in the nationwide rail network.

Several issues are at stake, chief among them something called “forced access.” Complicated in both practice and theory, this process would force railroads to open their privately owned facilities and lines up for use by their competitors at rates and schedules determined by the government. While railroads currently enter “reciprocal switching” agreements voluntarily, forced access would replace rate negotiations between rail companies with government control.

The Rail Customer Coalition (RCC), a group of shippers calling for these proposals, has made several arguments for freight rail re-regulation. Below, we’ve provided a point/counterpoint look at forced access.

RCC Claim: Forced access is a step toward more competition

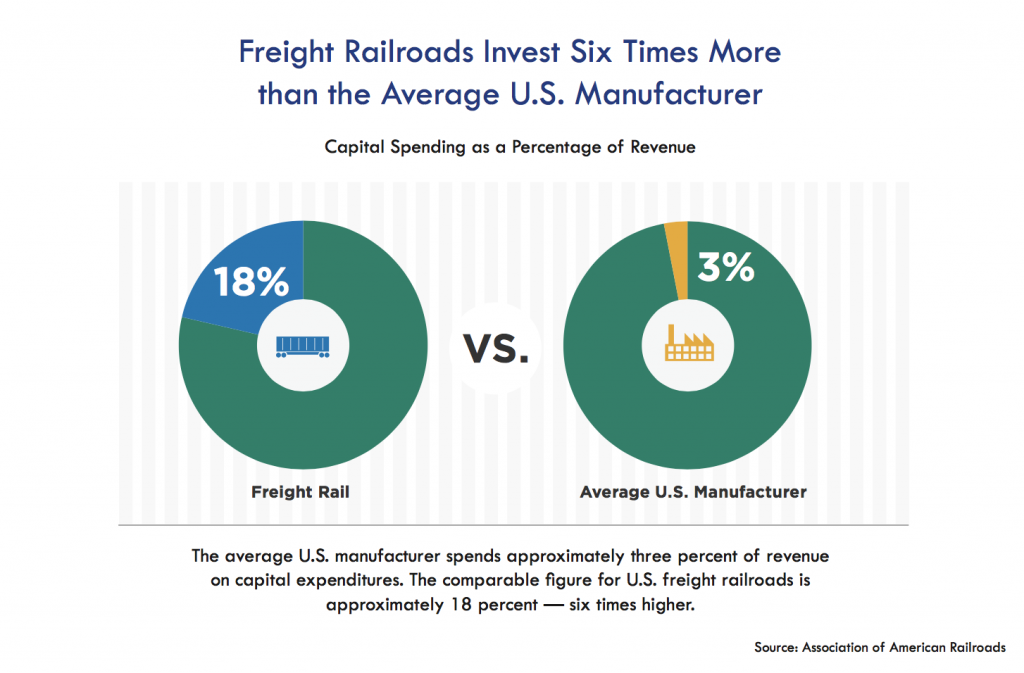

Reality: The very nature of forced access – the government stepping in to compel one company to use privately owned facilities on behalf of a competitor – is antithetical to the free market. Rail infrastructure is not only privately owned, it is also massively expensive; for example, railroads typically need to reinvest into maintaining and growing their lines at six times the rate of the average manufacturer. Overregulation would strangle rail’s ability to invest, hurting competition.

RCC Claim: Forced access would benefit shippers and Americans at large

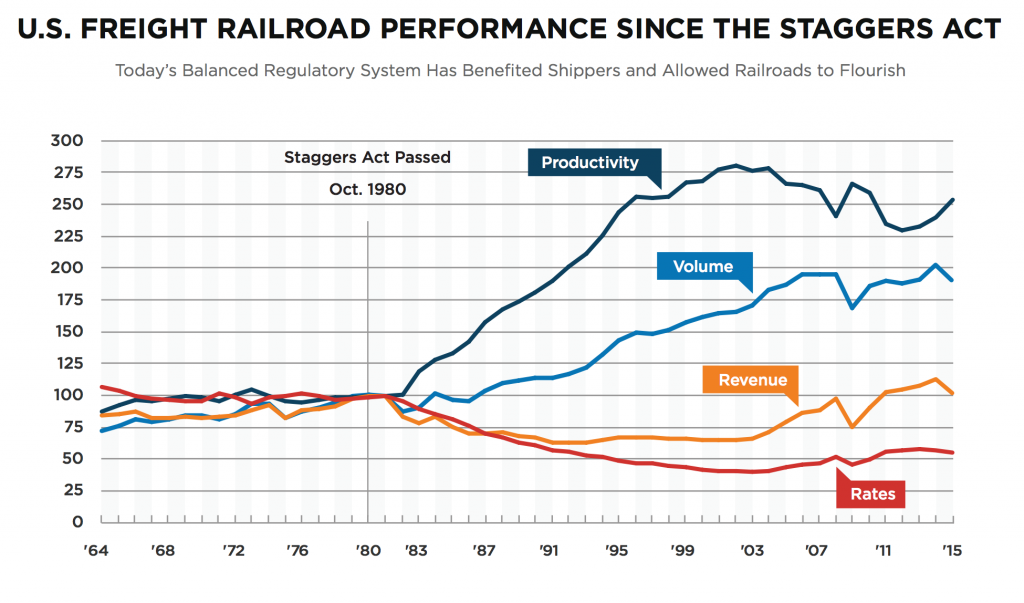

Reality: In fact, freight rail re-regulation and forced access would ultimately undermine the efficiency and safety of the 140,000-mile rail network that shippers and consumers rely on. We’ve seen this before – railroads have not always had the ability to invest at levels high enough to sustain healthy rail lines. Before the Staggers Act of 1980 replaced government controls with the balanced regulations we have today, much of the rail network had fallen into disrepair because railroads could not invest.

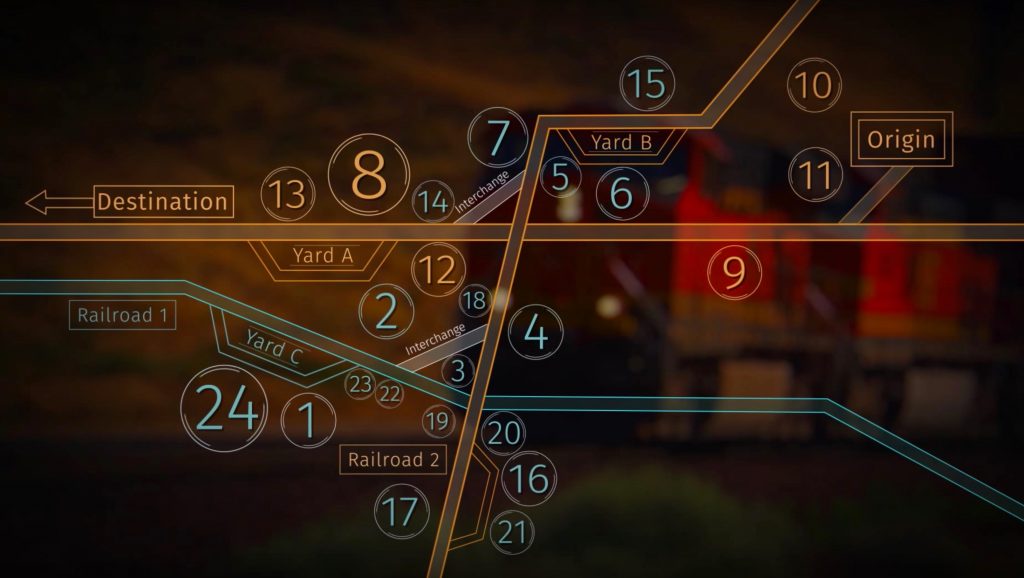

In addition to the threat of diminished private rail spending, forced access would have real time costs for shippers because it complicates the switching process exponentially. One evaluation of a similar proposal said that forced access could affect an estimated 7.5 million carloads of traffic, jeopardizing $8 billion in revenues. It is for this reason that UPS, one of the biggest shippers in the country, opposes the rule.

RCC Claim: Re-regulation proposals are necessary to update outdated policy

Reality: Today’s balanced rail regulations have benefited and continue to benefit shippers, consumers and rail carriers alike. Since 1980, rail investments topping $630 billion have given America the world’s safest, most efficient and productive rail network and helped cut shipper rates by 45 percent, meaning that shippers today can move nearly twice as many goods for about the same price they paid 30 years ago.

What’s more, in bipartisan legislation supported by both shippers and railroads, Congress reauthorized the STB in 2015 for the first time since 1996. The legislation increased the board’s membership from three to five and streamlined its process for reviewing rate cases. Despite these reforms, and the process in place since the 1980s that allows shippers to petition for a forced reciprocal switching arrangement, no shipper has ever demonstrated anticompetitive behavior by railroads.

There’s a lot at stake here. The rail renaissance that we’ve seen since the 1980s, and the smart regulations that catalyzed it, are not idle anecdotes but lessons to be heeded. Policymakers should continue to encourage rail investment by rejecting forced access and other proposals to re-regulate railroads.