Carson City, NV — Ports have always been more than simply locations where ships are loaded and unloaded. They are places where shipments and containers are received, processed through customs, inspected, sorted, and transferred to rail or trucks for delivery to end users and customers.

During the 1990s, freight transport shifted inland due to congestion, energy consumption, and “empty moves” (empty containers). Coastal ports were constrained by capacity limits, causing congestion in and around them. In addition, the lack of real estate available for seaport expansions caused a dramatic increase in the cost of land and lease rates.

Hundreds of inland ports have been established since the 1990s, beginning on the East Coast and gradually expanding to the Western U.S. They have quickly become integral to the U.S. economy and integrated into the global supply chain and the logistics industry. Key drivers have been increasing the speed to market for finished goods, providing the lowest shipping costs, and leveraging existing freight rail infrastructure.

There are two categories of U.S. inland ports. Both enable trade and commerce by complementing a region’s competitive advantage and partnering with the existing freight rail network. Inland ports established across the U.S. over the past two decades are usually based on one of a handful of proven business models depending on trade needs, location, and services offered.

A wet port is an inland port located on an inland waterway, such as a river, lake, or canal. It may or may not be connected to the sea. While they carry millions of tons of cargo each year, it is chiefly breakbulk items like coal, iron ore, heating oil, gasoline, lumber, and agricultural commodities.

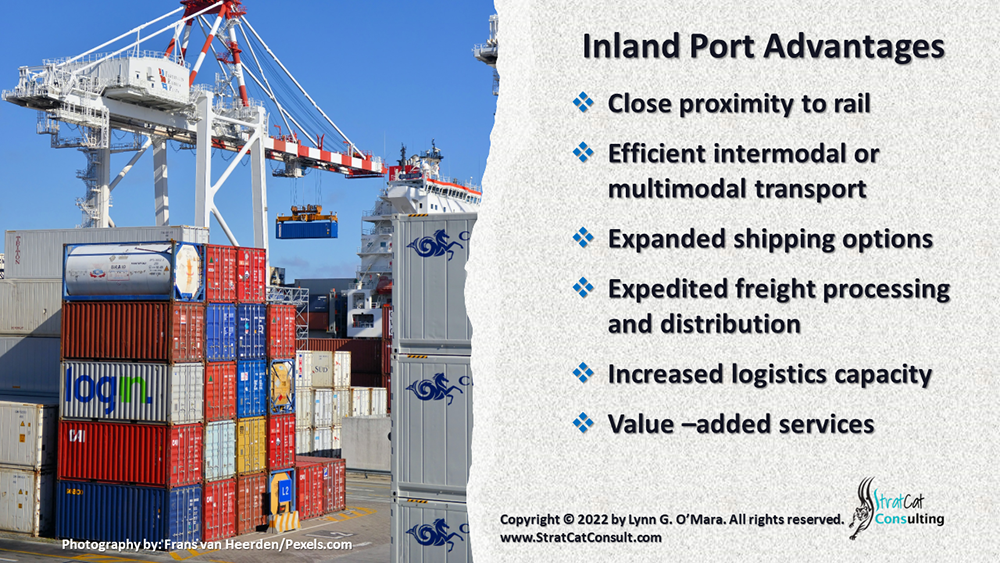

An inland intermodal or multimodal facility directly connected by freight rail or highway to a seaport is known as a dry port. It operates as a hub for the shipment of sea cargo to inland destinations. Dry ports often include value-added services such as customs clearance, transloading, warehousing, distribution, manufacturing, and/or facilities for the maintenance of rail and road cargo carriers.

Many dry ports have been established as industrial parks owned and operated by private entities and may include freight rail investment. Because they are not usually fixed locations and may operate within non-contiguous borders, these inland ports serve as the connector between freight rail, air cargo, and trucking shipments for both manifest and intermodal freight located in multiple locations. They may also be a designated U.S. Foreign-Trade Zone (FTZ) to better meet import-export needs.

Global supply chain disruptions during the pandemic have led to U.S. manufacturers reshoring or expanding U.S. production. Prior to that and now, the Southwest is rapidly becoming the newest center for manufacturing and technology. Five states – Arizona, Nevada, New Mexico, Oklahoma, and Texas – accounted for 30% of U.S. manufacturing job growth, adding 100,000 jobs from 2017-2020.

Manufacturing growth in this region continues today as companies there are producing everything from steel to electronics to electric cars. Tesla is establishing a new assembly plant and battery factory in Texas. In Arizona, an expanding semiconductor industry has earned the Silicon Desert moniker. Taiwan Semiconductor Manufacturing Co. (TSMC) is building its newest chip factory there, and Intel announced significant investments to expand its chip manufacturing in both Arizona and New Mexico.

The geographic Southwest region intersects with the economic Southwest Megapolitan Cluster – Southern California, Las Vegas Metro, and Arizona’s Sun Corridor (Phoenix to Tucson). All of the intersecting states encompassed are part of the national freight rail system, and most of them have established inland ports. The manufacturing growth in these areas is creating opportunities for increased freight rail shipping services and for the establishment of new inland ports. Recently, for example, two inland port projects in Southern California have been proposed.

The inland port concept is not new and has proven that some seaport functions can be duplicated or completed at inland locations. Spurred by the seaport and traffic congestion experienced during the past two years, private companies are exploring investment opportunities to improve local freight rail infrastructure and to either establish new inland ports or expand existing ones. Giving shippers more options in selecting shipping routes and warehousing locations can help grow the U.S. freight rail industry and our national economy.